Hey guys, hope all is well. Thought it was time for another blog post. This is a continuation of the last post, just various thoughts and experiences I’ve had of late.

- Why I use wide stops?

I’ve gotten quite a few DMs about my stops and why Im willing to take such large % losses as part of my strategy. I go into why in my first post and it all has to do with maximizing expected growth.

The number one objective in trading is to maximize bankroll growth. Phrases like “cutting losses quickly”, and “positive risk/reward ratios” are thrown around often, but is that the best way to grow an account? The only number that matters is expected growth%. I let the math guide my decisions, regardless of what I think or how uncomfortable it is. Let me show you why:

From my first blog post:

Expected Growth (EG) = (1 + (O-1) * S)p * (1 – S)1-p – 1

EG = 16%

Once again, the actual algebra isn’t important, just understanding the overall concept is key.

We can see that expected growth takes into account all of the important ratios and sums up the strength of your system. Take a look at the following systems:

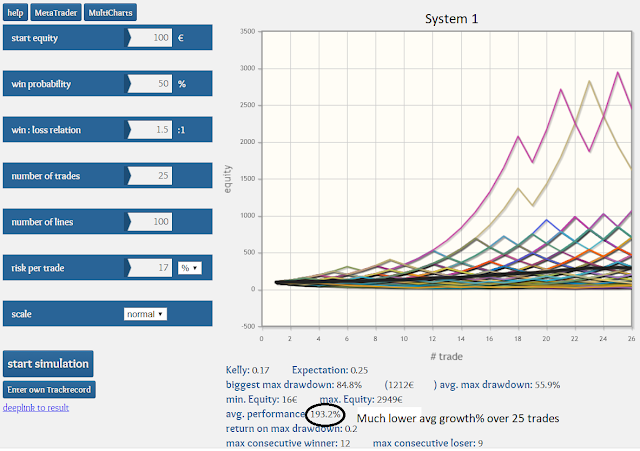

System 1

Win rate: 50%

Profit Ratio: 1.5:1

Profit Target: 15%

Stop Loss: 10%

Edge: 25%

Kelly Stake: 16.67%

Expected Growth: 2.06%

System 2

Win rate: 80%

Profit Ratio: 0.5:1

Profit Target: 25%

Stop Loss: 50%

Edge: 20%

Kelly Stake: 40%

Expected Growth: 4.47%

System 1 would be considered “ideal” by most in the trading community. Positive profit ratios, tight stop loss%, and a 50% win rate.

System 2 is closer to the ratios I have adopted in my strategy. On paper it looks ugly. Sub 1 profit ratios, wide stop loss%, lower edge%. But the only number that matters, expected growth%, is more than DOUBLE that of System 1.

Here’s why: System 2 has a much higher win%, and the effect that has on the compounding factor is huge. System 2 has a higher probability of growing your bankroll on a trade to trade basis, which means each subsequent trade is with a larger bankroll on average, which means larger position sizes on average, which means larger dollar gains on average. And that power is reflected in the higher Kelly stake%. The math is telling you to risk more since the reward is higher. We can see this effect using the equity curve simulator:

Keep in mind this approach isn’t for everyone. With aggressive strategies like this your max drawdown will be much higher and you have to prepare yourself for some heavy losses. Ask yourself if you can stay disciplined in such instances. Will you be able to cut the loss instead of adding or getting stubborn and holding on? Watching a ticker rip against you 20, 30, 40% or more isn’t fun and neither is stopping out at the highs and watching it fade all day, but the math says this is the best way to grow your bankroll. No matter how uncomfortable it feels, force yourself to follow the plan and execute in the aggregate.

*These simulations are using full Kelly stakes, I always recommend using fractional Kelly stakes (<50%) in order to reduce volatility and protect yourself from over-estimating your edge, which is very common.

- Short term variance

The small cap markets have been incredibly volatile the past few months. We have seen quite a few 100-200% runners. As a result, my system has under-performed historical averages over that time frame. When things are going smoothly you never look at things closely, but when you are losing you spend countless hours analyzing the data trying to find the problem. The problem with this mentality is that if you look close enough you will always find outliers in the data. Its hard to know if its just short term variance, bad luck, coincidence, whatever you want to call it, or if its a legitimate red flag that needs to be filtered out. Only over a large sample or with enough logical reasoning can you make that decision. Bottom line, dont get shaken out by short term variance.

Example:

I recently tweeted about the amount of china runners resulting in losses and how my overall numbers have been poor on those plays. The reason why I didn’t change my approach is because the sample size of that data was small, only 88 total plays. If the sample had been over 300 or so plays then I would probably cut china stocks out completely. I also couldn’t come up with a logical explanation why china stocks would be more or less volatile or have higher squeeze potential than other setups.

In a short time period, variance and volatility is expected, the key is to have a consistent approach that will work in the aggregate. Dont over-react to every little change you see. The markets are cyclical, they are dynamic, they ebb and flow from one end of the spectrum to the other. In periods of volatility like this, exercise extreme discipline and risk management. Your rules will be tested by the market, weather the storm and be rewarded for your consistency in the end.

- Breaking Rules and how to prevent it

I recently had a period where I fell into old habits of breaking rules and undisciplined trading. The ugly 10k red day I posted recently was actually the 3rd or 4th day I had broken rules, but the first time where I actually got burned by it. Once you break a rule it becomes so much easier to do it again, since that initial threshold has been broken and you rationalize to yourself that it isn’t such a big deal, especially if you win.

After breaking a rule, either you win and the significance of the rule break isn’t realized, or you lose and feel disgusted with yourself. If you follow rules and lose its not a big deal, just part of the process. The problem with breaking rules is that you put yourself in a must win situation.

That realization is what I plan to use going forward to deter rule breaking. “If I take this low quality trade, or break this rule, then I HAVE to win, otherwise I will feel like an idiot”. And as we all know there is no trading setup with a 100% win rate, so you will inevitably feel that deep level of disgust in yourself. Is that feeling worth breaking your rules? When you think in these terms you will never break a rule again. And if you happen to slip up, step away from the computer immediately. You need to punish yourself, and the best way to do that is stop trading for the day.

Another tip that may help is take screenshots of all your blowups or ugly trades where rules are broken, make a collage and post them on your computer or desk. Use them as a reminder of what happens when rules are broken.